Free Debt Recovery

Free Debt Recovery – fact or fiction?

Is it really possible to get your debts recovered for free?

When you chat with a debt recovery company, they’ll often tell you that once they’ve successfully collected all your money, it’ll essentially be “free.” I’ve been there, done that, and I can tell you, that’s usually not how it works out. Let’s look at a few scenarios:

“No Win, No Fee” Debts

With this setup, you don’t pay anything upfront. Any commission they charge (if they actually collect the money) can sometimes be offset by interest and/or fees, thanks to The Late Payment of Commercial Debts (Interest) Act 1998. But here’s the catch: this only applies to business debts. If your debtor isn’t a business, the only solid way to reclaim those costs and interest is by taking them to court. Court proceedings, however, should always be a last resort. So, more often than not, you’ll end up paying that commission. Make sure to double-check the debt collector’s terms, as I’ve seen commission rates as high as 50% of the debt!

That said, I have to admit that in many cases—including when I ran my own debt collection company—we did manage to collect the debt, the costs, and even some interest. So, technically, there are situations where “free debt recovery” is possible with a “No Win, No Fee” arrangement.

Fee-Charging Debt Recovery Companies

Here, you pay an upfront fee, which then gets added to the debt and is supposed to be collected back for you. Interest can also be added to cover some or all of the commission. You’d hope these companies have more resources than their “No Win, No Fee” counterparts (though be warned, only a handful actually live up to their claims).

So, the debt gets collected, but only the original balance is paid directly to you. Then, you get an invoice for the commission. You pay it, and then the debt collection company has to go and try to recover your fees. How much effort do you think they’ll really put into recovering your costs, especially since there’s no additional commission for them on that part?

Still, there are times when a debtor will pay the debt, the costs, and some interest, which can then be used to offset your commission.

Solicitors

Probably one of the most straightforward things about most solicitors is that they’ll charge you as they go – and they’re not shy about telling you so. But WATCH OUT! They’ll almost certainly try to steer you towards a court hearing, just to keep that cash register ticking over. Plus, they’ll charge for credit checks, tracing services, and just about everything else. Many will even bill you for the time they spent in the restroom, claiming they were “thinking” about your case. There are a few good eggs out there, but it took me over 20 years to find them.

On very, very rare occasions, a solicitor might take your debtor to court and win back all your costs. But remember, a judgment award (like a CCJ) is essentially just a piece of paper. You still haven’t actually gotten your money back. I recall one massive case where a solicitor friend of mine won a huge judgment against a former Premier League player – upwards of £400k! All costs were awarded to the claimant, but the solicitor is still trying to enforce that judgment five years later.

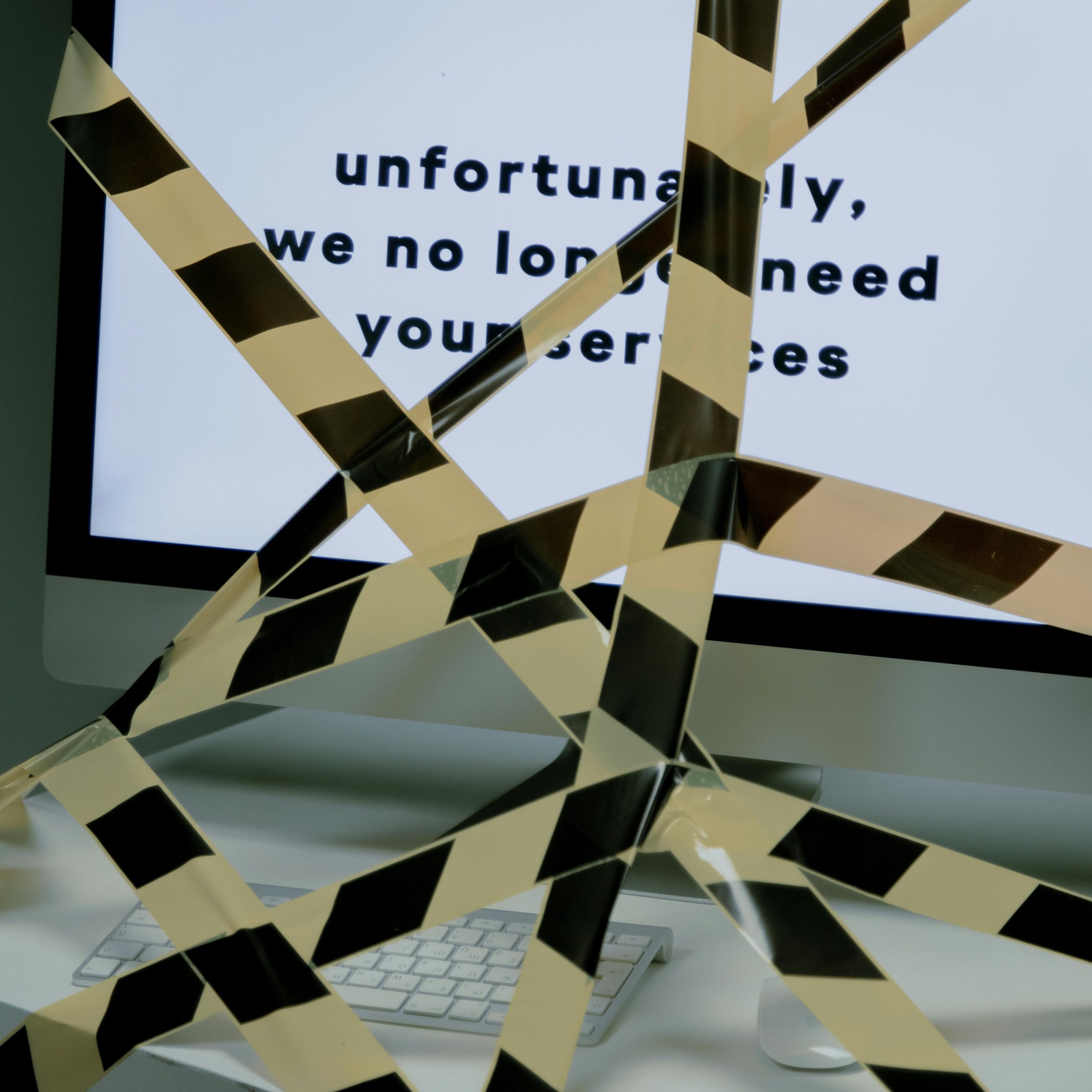

My Two Cents on “Free Debt Collectors”

Honestly, forget “No Win, No Fee.” At best, you’ll get a company that sends out some stern letters, texts, or emails. And maybe you’ll have 5-10 telephone agents, each juggling about a thousand cases. I’ve been there, seen it, done it. I even used to drive around the debtor’s car park and tell them I was on my way! Most debtors know they’ll never actually get a visit and will just laugh it off or block the agency.

I’d estimate that “No Win, No Fee” debt recovery companies successfully collect about 1 in 10 debts they take on. And out of those successfully recovered debts, only about 1 in 10 will have all fees recovered. So, to put it another way, there’s roughly a 1% chance of a “No Win, No Fee” company actually providing you with a truly “free” debt recovery service. (Sorry to any of my friends working for or owning these companies, but you know I’m right!)

Instead, find a debt collector who charges reasonably and clearly breaks down what they’ll do for you. If a solicitor charges £350 for just one letter, then a debt recovery company charging the same amount for address checks, credit history checks, and actual visits and calls to your debtor is giving you a fair deal. But don’t expect them to do much more for £350. In fairness to the debt collector, if they’ve done all that, I think it’s a fair price.

Rough statistics suggest that fee-charging debt recovery companies successfully recover about 2-4 out of every 10 debts. The companies I work with now are more selective and won’t just take on anything to get a fee – thanks to Trustpilot and Google Reviews! Of those 2-4 debts recovered, 1-2 will have all their costs and commission recovered, making this option your best bet.

What Can You Do Before signing up to no win, no fee?

Check out my free guides, of course! Or take a look at some of my recent blogs below.