DIY DEBT RECOVERY

Checks that you can do yourself before you call in the debt collectors

Lent a friend or family money, paid a builder who disappeared, you’re a landlord whose tenant has fled, your ex-partner still owes you money, bought a car that conveniently blew up on the next street, Crypto…

Who are you about to engage with?

Where do they live?

You can’t chase a ghost.

Do they have CCJ’s?

Or perhaps they have an IVA or bankruptcy?

Do they have any assets?

Knowing this can be very helpful.

Follow these Pre Debt Recovery basic checks

Follow these Pre Debt Recovery basic checks

25 Years of Common Sense

A bit from tim

Knowing a bit about your client before you engage with them is vital. I have provided as many free/cheap tools as I can. However, if you are about to extend a serious amount of credit (or similar), you might be better off getting a full asset report. Also known as a ‘pre-sue’ report, this will give an in-depth review of your ‘Pre-debtor’. Knowing your customer can help keep them from becoming debtors!

There are some companies that charge a fortune, so by all means, get in touch with me and I will try to point you in the right direction.

Get a bit more from Tim

Sign up for the not-so-weekly Debt Recovery News Letter

25 Years of Common Sense

The steps to follow

to prevent debtors

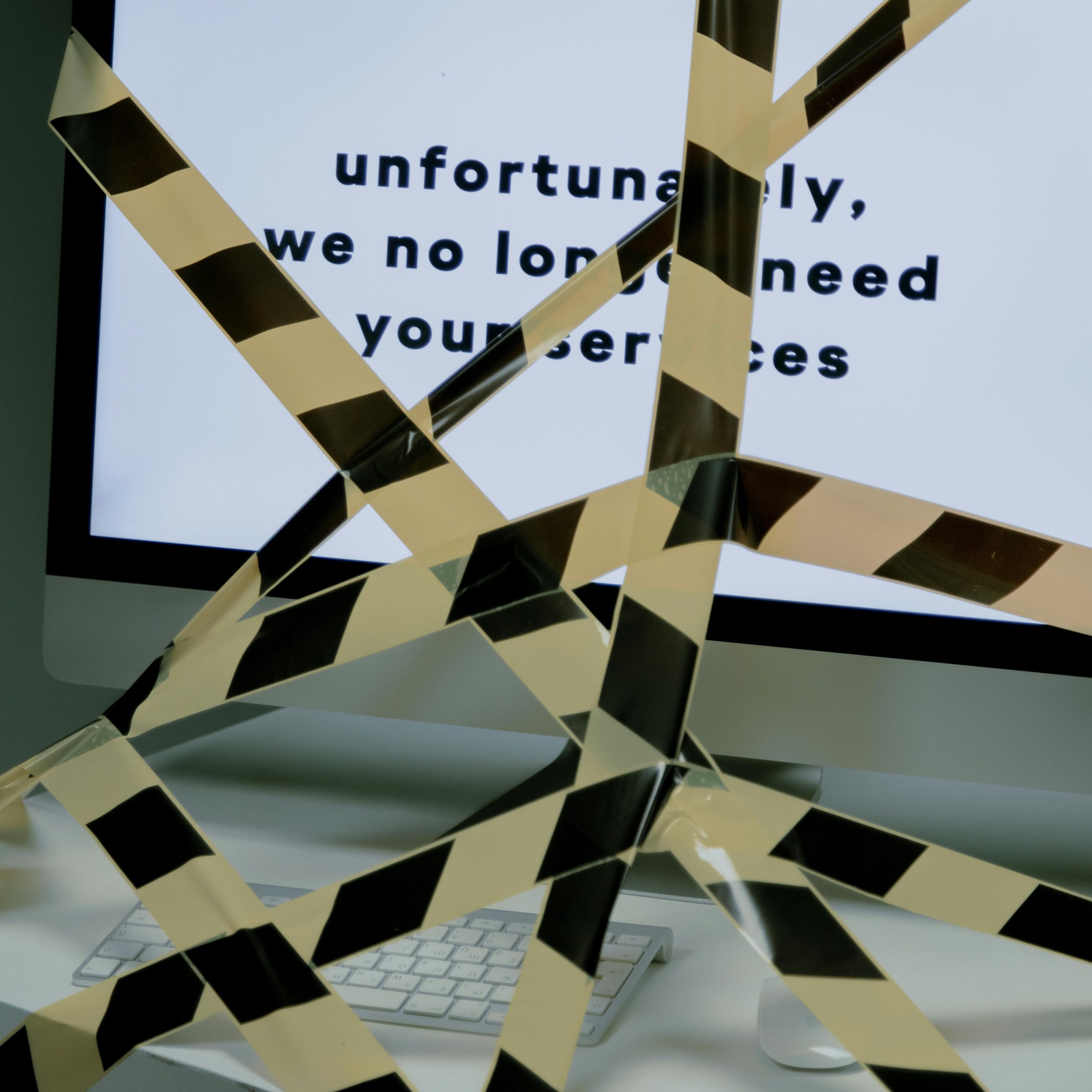

Don’t let your best sales become bad debts

Professional Advice

It’s taken 25 years of being a debt recovery professional to spot an obvious debtor. If after your potential debtor checks, you are still unsure, get in touch and I’ll do my best to help.

25 Years of Common Sense

what people are saying

A few recent reviews from people I’ve helped recover their debts

Very professional, polite and great to deal with! Comes highly recommended! Thank you!

Adrian Cox

Fix-A-Floor UK

Tim solved a long standing debt for us, and worked quickly and efficiently to get the matter resolved. I’d recommend Tim to anyone in the same situation – he get results fast and allow you to get on with your business safe in the knowledge that they will get the money you are owed.

Annabel Hilary

PR When you need it

Tim has been really helpful and professional. Thank you for your great work.

David Perchet

Balfour Beatty